Our ICB Courses

ICB Business Management Programme:

Small Business Financial Management: ICB National Certificate

Office Administration – Business Management: ICB Higher Certificate

Financial Accounting – Business Management: ICB National Diploma

ICB Office Administration Programme:

Office Administration: ICB National Certificate

Office Administration: ICB Higher Certificate

Office Administration: ICB National Diploma

ICB Financial Accounting Programme:

Bookkeeping: ICB FET Certificate

Bookkeeping: ICB National Certificate

Certified Financial Accounting: ICB National Diploma

Technical Financial Accounting: ICB National Diploma

What Are ICB Courses?

ICB Courses are business courses that are designed and examined by the Institute of Certified Bookkeepers. The courses are offered by ICB Accredited Colleges either by contact learning or by distance learning.

Matric College is accredited by ICB to offer ICB courses via distance learning. This means that you can study an ICB course from the comfort of your space and at your own pace. Matric College offers 3 ICB Programmes namely:

ICB Courses provide you with scarce skills. These courses are focused on specialised learning that are in great demand.

Watch Our College Principal Introduce The ICB Qualifications Offered At Matric College

ICB Business Management Courses

Small Business Financial Management: ICB National Certificate

SAQA ID: 48736

Course Credits: 120

NQF Level: Level 4

Qualification Title: Small Business Financial Management: ICB National Certificate

Qualification Type: National Certificate

Course Duration: 9 -12 Months

Entry Requirements

- Grade 11 (NQF 3)

- Grade 11 Equivalent Certificate

- ICB Junior Bookkeeping: National Certificate

Course Subjects

- Business Management 1

- Bookkeeping To Trial Balance

- Business Literacy

Office Administration - Business Management: ICB Higher Certificate

SAQA ID: 23619

Course Credits: 240

NQF Level: Level 5

Qualification Title: Office Administration – Business Management: ICB Higher Certificate

Qualification Type: Higher Certificate

Course Duration: 15 – 28 Months

Entry Requirements

- Small Business Financial Management: ICB National Certificate

(Must include the Business Management 1 subject)

Course Subjects

- Office and Legal Practice

- Business Management 2

- Marketing Management and Public Relations

- Financial Statements

- Human Resources Management and Labour Relations

Financial Accounting - Business Management: ICB National Diploma

SAQA ID: 20366

Course Credits: 280

NQF Level: Level 6

Qualification Title: Financial Accounting – Business Management: ICB National Diploma

Qualification Type: National Diploma

Course Duration: 12 – 36 Months

Entry Requirements

- Office Administration: Higher Certificate

(Must include the Business Management 2 subject)

Course Subjects

- Office and Legal Practice

- Business Management 2

- Marketing Management and Public Relations

- Financial Statements

- Human Resources Management and Labour Relations

ICB Office Administration Courses

Office Administration: ICB National Certificate

SAQA ID: 23618

Course Credits: 120

NQF Level: Level 5

Qualification Title: Office Administration: ICB National Certificate

Qualification Type: National Certificate

Course Duration: 18 – 24 Months

Entry Requirements

- Grade 12 or Equivalent

- You must be 16 years or older

- No prior accounting knowledge needed

Course Subjects

- Bookkeeping and Office Administration

- Bookkeeping to Trial Balance

- Business Law and Administrative Practice

- Business Literacy

- Cost and Management Accounting

- Marketing Management and Public Relations

Office Administration: ICB Higher Certificate

SAQA ID: 23619

Course Credits: 240

NQF Level: Level 5

Qualification Title: Office Administration: ICB Higher Certificate

Qualification Type: Higher Certificate

Course Duration: 9 – 28 Months

Entry Requirements

- Office Administration: ICB National Certificate

Course Subjects

- Business and Office Administration (BOA2)

- Human Resources Management and Labour Relations (HRLR)

- Economics (ECON)

Office Administration: ICB National Diploma

SAQA ID: 35958

Course Credits: 360

NQF Level: Level 6

Qualification Title: Office Administration: ICB National Diploma

Qualification Type: National Diploma

Course Duration: 9 – 36 Months

Entry Requirements

- Office Administration: Higher Certificate

Course Subjects

- Business and Office Administration 3 (BOA3)

- Financial Statements (FNST)

- Management (MGMT)

ICB Financial Accounting Courses

Bookkeeping: ICB National Certificate

SAQA ID: 58375

Course Credits: 120

NQF Level: Level 3

Qualification Title: Bookkeeping: ICB National Certificate

Qualification Type: National Certificate

Course Duration: 12 -16 Months

Entry Requirements

- Grade 10 (NQF 2)

- Grade 10 Equivalent Certificate

- No prior accounting knowledge needed

Course Subjects

- Bookkeeping to Trial Balance (BKTB)

- Payroll and Monthly SARS Returns (PMSR)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

Bookkeeping: ICB FET Certificate

SAQA ID: 58376

Course Credits: 130

NQF Level: Level 4

Qualification Title: Bookkeeping: ICB FET Certificate

Qualification Type: FET Certificate

Course Duration: 6 – 24 Months

Entry Requirements

- ICB Junior Bookkeeping: National Certificate

Course Subjects

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

Technical Financial Accounting: ICB National Diploma

SAQA ID: 36213

Course Credits: 251

NQF Level: Level 5

Qualification Title: Technical Financial Accounting: ICB National Diploma

Qualification Type: National Diploma

Course Duration: 6 – 28 Months

Entry Requirements

- ICB Senior Bookkeeping: Further Education And Training Certificate

Course Subjects

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

Certified Financial Accounting: ICB National Diploma

SAQA ID: 20366

Course Credits: 280

NQF Level: Level 6

Qualification Title: Certified Financial Accounting: ICB National Diploma

Qualification Type: National Diploma

Course Duration: 12 – 36 Months

Entry Requirements

- ICB Technical Financial Accounting: National Diploma

Course Subjects

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

Top 10 Reasons To Study An ICB Course At Matric College

There are many benefits of studying ICB Qualifications with us.

Here are the top 10 reasons why you should study with us:

- We are an official provider of ICB Courses

- We offer three ICB Qualification programmes

- The entry requirements are easy to meet

- You can choose to study full-time or part-time

- We are a distance learning institution so you do not have to attend any classes

- You can complete your course based on how quickly you learn

- We offer the most up to date syllabus

- Our study materials are carefully written to give you the best learning experience

- ICB Courses are internationally recognised

- We offer student support weekdays between 8 am – 5 pm

The Institute of Certified Bookkeepers (ICB) is an accredited Business Qualifications institute. They are an independent external examination for the three ICB programmes they offer.

Matric College is one of 500 ICB Accredited Qualification Providers in South Africa offering you an improved educational experience through distance learning.

An ICB Certificate is a Qualification that you will receive after you have completed the ICB Course you studied. Immediately after receiving your exam and PoE results, you will receive

- An ICB Programme Certificate

- A Statement of Results

You can use your ICB Programme Certificate to apply for further studies or employment while you wait to receive your ICB Qualification Certificate.

Once you have been declared competent in the course you studied, ICB will authorise FASSET to print your certificate and send it to Matric College for it to be awarded to you at your graduation.

ICB no longer award certificates for each subject you complete but for the entire course. Your Programme Certificate and Statement of Results are proof that you completed your subject.

Digital Certificates are available for Download on the ICB Student Portal under the “My Reports” tab.

Scarce Skills are career-focused skills that are in demand. Employers want to hire people that are skilled which puts you at an advantage if you are qualified in careers that are regarded as scarce. There are many scarce skills in South Africa

10 South African Employment Sectors Where Scarce Skills Are In Demand

- Business Management and Economics

- Financial Accounting

- Sales, Marketing and related associated professions

- Information Technology and Communication

- Engineering

- Health Professionals and Related Clinical Sciences

- Architects, Town Planners and Surveyors

- Media Professionals, Artistic, Literary and Design

- Sport and Fitness

- Quality and Regulatory Professionals

Apart from being able to study an ICB Scarce Skill Qualification without a Matric Certificate, there are plenty of other benefits of pursuing a Scarce Skills career. From having a wide range of career options to working abroad. Here are the benefits of choosing a career that is regarded as a Scarce Skill:

- Variety of Career Options

- Hiring Opportunities

- Increase Your Income

- Move Up The Corporate Ladder

- Travel And Work Abroad

- Local And International Accreditation

Variety of Career Options

By gaining a scarce skill you are widening your career options. Many occupations are in demand based on the 10 employment sectors listed above.

Hiring Opportunities

When you apply for a job, employers look at whether you have any scarce skill qualifications or scarce skills. If you have scarce skills or a scarce skill qualification you will most likely be shortlisted in the company’s job search, provided you meet their other requirements. Employers look for people with scarce skills.

Increase Your Income

Having a scarce skill will earn you positions in an organisation that pays more. This means that you will be able to fall into a higher income bracket and earn according to the qualifications and skills that you have.

Move Up The Corporate Ladder

Advance your career by acquiring scarce skills and climbing the corporate ladder. Scarce skills allow you to fill employment gaps that are needed.

Travel And Work Abroad

Scarce skills are not only in demand in South Africa but some can be around the world too. You can use some of the scarce skills you have acquired to apply for work abroad. You will be able to travel and work while learning about you will meet abroad.

Local And International Accreditation

The ICB courses we offer are nationally and internationally recognised by the

- National Qualifications Framework (NQF)

- The South African Qualifications Authority (SAQA)

- The Quality Councils for Trade and Occupations (QCTO)

The Chartered Institute of Management Accountants (CIMA) and the Association of Chartered Certified Accountants (ACCA) are International Bodies that recognise ICB Qualifications for either memberships or exemptions for further study.

Critical Skills are the skills you need to do the day-to-day duties in your career. These are skills that you will naturally have or will have to master the technique to be successful in your occupation.

Here are the Top 5 Critical Skills that are needed for almost every role:

- Analytical Thinking

- Good Communication

- Problem Solving

- Open-Mindedness

- Creative Thinking

Analytical Thinking

Technology in the workplace is playing a vital role in the operations of any business. Along with technology comes data reporting that allows you to measure the growth of your business. Being able to think analytically will help you report and understand complex reports and measurements.

Communicating them to internal and external stakeholders will see your business doing well.

Good Communication

Good communication skills are the absolute critical skill to have to ensure there is a good flow of communication in the workplace. Businesses are operated by a team that comes together for a common goal and communication is key in any organisation.

Businesses are not immune to problems and you will encounter them in the workplace.

Problem Solving

Knowing how to solve problems is critical as there will always be challenges in any organisation. These problems require you to identify, report them effectively and solve them for the success of your business.

Problems are complex and they require you to be open to opinions, suggestions and corrections.

Open-Mindedness

Having an open mind is critical in any role you find yourself in. There are many moving parts in businesses and they require you to have an open mind. Open-mindedness allows you to be open to changes that can happen.

Additionally, having an open mind allows for innovation to be at the forefront of any business.

Creative Thinking

Creative Thinking is an important Critical Skill to have because it allows you to be innovative in your career. Businesses are constantly evolving to find new ways to reach their customers and being able to think of creative ideas will see you and your business do exceptionally well.

| Scarce Skills | Critical Skills |

|

|

Yes, you can get credits for previous work experience and studies already completed. It depends on whether you meet the requirements. When you study an ICB Course you can apply for Recognition of Prior Learning (RPL) either for a previous course you did or if you have previously worked in a role related to the ICB Course.

- Familiarise yourself with the Guidelines for RPL

- Submit your ICB Student Details Form with your proof of payment of the RPL administration fee

- Submit a detailed CV

- Submit academic transcripts of any registered qualifications you have completed

- Submit the accreditation certificate, or proof thereof, of the provider for your previous qualification

- Submit the NQF level and SAQA ID of the previous courses you completed

- The ICB will review your application for RPL and offer you credits where applicable

ICB Courses At Matric College, How It Works:

Step 1: Complete the “Download Brochure Form” at the bottom of this page.

Step 2: Our course experts will contact you and register you for an ICB Course.

Step 3: Upon successful completion of your registration, we will send your coursework and study material via courier.

Step 4: Register as an ICB student as instructed in your registration pack.

Step 5: Register your student account on MACCI to build your Portfolio of Evidence (PoE).

Step 6: Complete and submit your assignments on MACCI.

Step 7: Write open book tests online using the MACCI Portal.

Step 8: Complete the exam entry form on the ICB Student Portal to register for the final exam.

Step 9: Write your ICB final exam online or in person (Remember to submit your digital PoE).

Step 10: An ICB Qualification will be awarded to you by Matric College once it is received from ICB and FASSET.

The ICB Student Portal is an online platform for students who are studying an ICB Course. You can use this platform for various student activities including

- Registering as an ICB student

- Registering for the ICB Exam (This is NOT completed by Matric College)

- Receiving a digital copy of your exam admission letter

- Updating personal details

- Paying ICB fees

- Keeping up to date with the progress of your course

- You will receive login details for MACCI after you have entered a digital PoE Exam

- Click on Courses to start your digital PoE

- Complete your course step by step, the platform will guide you along the way

- All the declarations are completed online while completing the PoE

- You must complete each study step as shown on MACCI

- You can complete a section at a time and come back at another time to complete the next section.

- You can track the progress of your studies with the progress bar

- You will know you are finished with your PoE if the progress bar is at 100%

The ICB exams are written every second month so as you complete a subject you can write the exam. There are exam venues across South Africa. An option that is becoming more popular is being able to write the exam online from the comfort of your home.

Here is the exam 2022 timetable for the ICB exam. You can download the timetable to plan your studies accordingly.

As mentioned above, you can use the ICB Student Portal to register for your exams. Here is how you can:

- Register as an ICB Student by submitting the Student Details Form (this process is already done when you register for a course)

- Complete the Exam entry form using the dates available in the timetable.

- You can choose whether to write your exam in person or online. If you choose to write in person you will need to select an exam venue as listed on the Student Portal.

- ICB will issue you an admission letter you can use to write your exam.

In-Person ICB Exam

In-Person ICB exams are written at designated exam venues and are run by ICB and their invigilators. Exam venues can include college facilities that are approved by ICB. To be admitted to the exam venue, you need to present proof of identification which can include:

- A green-barcoded ID book

- An official ID card

- A passport

- A certified temporary ID document

In-Person exams are scheduled for morning sessions between 09:00 and 12:30 (three and a half hours). The first half-hour is for reading time and to explain the exam venue rules. If you arrive after the first half-hour, when the exam commences, you will not be allowed to enter the exam venue to write your exam.

Distance learning students have two opportunities to write the exam in person.

Smaller ICB exam venues have been discontinued due to the introduction of online exams. A lot of learners prefer writing online.

Online ICB Exam

The online ICB exam follows the same procedure and duration but is scheduled for the afternoon session between 13:00 and 16:30. You have to log in before the start of the allocated time. If you attempt to log in thirty minutes after the scheduled time (when the exam commences) you will be considered late and will not be able to log in and write the exam.

Just as in-person exams are invigilated, so are online exams. ICB has an online system that uses webcams on the students’ computers. This system uses facial recognition and tracks eye movement and computer activity outside of the exam webpage.

There is an online exam survey students are required to complete post-exam.

Distance learning students have six opportunities to write their exams online.

Are ICB Courses Recognised Qualifications?

Yes, ICB qualifications are recognised locally and internationally. Local recognition includes the

- NQF

- All ICB Courses are recognised by the National Qualifications Framework

- All ICB Courses are recognised by the National Qualifications Framework

- SAQA

- The South African Qualifications Authority registers all ICB Courses and they are issued with SAQA ID numbers detailing the credits you earn and the learning outcomes

- The South African Qualifications Authority registers all ICB Courses and they are issued with SAQA ID numbers detailing the credits you earn and the learning outcomes

- QCTO

- The Quality Councils of Trade and Occupations offers guidance to skills development providers private and public. ICB Courses are Scarce Skills Qualifications and they must be accredited by the QCTO to implement occupational Qualifications.

There are many options you have once you have completed an ICB Course. You can continue studying with ICB to reach the next NQF level or you can begin your undergraduate studies at a university. You can also use your ICB Qualification to join a professional body.

Study Further With ICB

ICB Courses progress from National Certificates (NQF 4) to National Diplomas (NQF 6). As you complete an ICB course at a specific NQF Level you can continue to study to achieve the next NQF level Certificate.

If you have progressed and earned all the Certificates offered for one ICB Stream you can complete another ICB Stream and earn those Certificates too.

Study Further Elsewhere

You can use your ICB Certificate/ Qualification to apply for undergraduate studies to achieve a degree. This all depends on the university and the Recognition of Prior Learning Policies they have in place.

Read up on them if this is an option you want to pursue or you can join a professional body that allows you to study further as a member.

Join a Professional Body

ICB recommends two professional bodies that recognise ICB Qualifications. They are the Association of Chartered Certified Accountants (ACCA) and the Chartered Institute of Management Accountants (CIMA). You can become a member of these professional bodies and even study further with them.

To get the current Matric College course fees and to find out about our payment options, please contact one of our course experts.

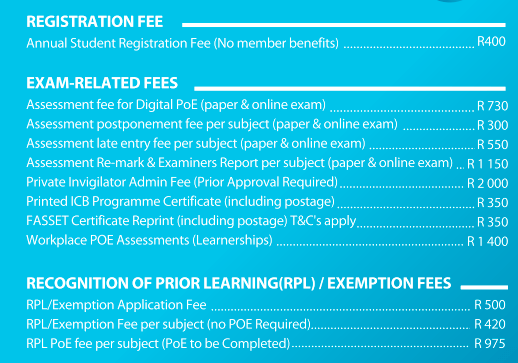

ICB has their own fees that should be paid directly to the institute. These fees are related to Registration fees, ICB Exam fees and Recognition of Prior Learning fees.

Below are the most updated prices of fees due to the ICB. Fees are correct as of the date of publication. Fees are subject to change.

Author: Mohamed S. Ajmoodien

Editor: Amy Venter

Date Published: March 30, 2022

Download a brochure

"*" indicates required fields